Stonewell Bookkeeping Fundamentals Explained

The Best Guide To Stonewell Bookkeeping

Table of ContentsOur Stonewell Bookkeeping DiariesAn Unbiased View of Stonewell BookkeepingEverything about Stonewell BookkeepingThe Ultimate Guide To Stonewell BookkeepingNot known Details About Stonewell Bookkeeping

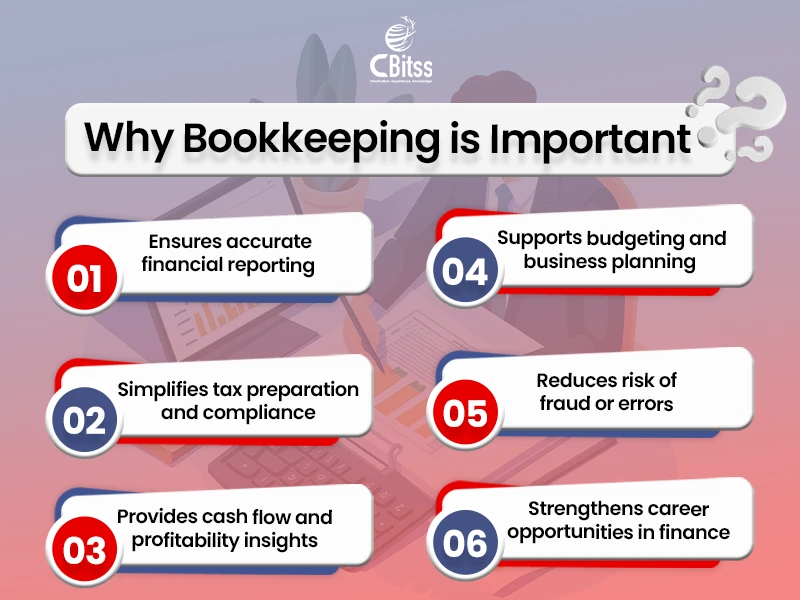

Right here, we address the inquiry, how does accounting aid a service? Real state of a company's funds and capital is constantly in change. In a sense, accountancy publications represent a picture in time, however just if they are updated usually. If a firm is absorbing bit, a proprietor has to act to increase revenue.

None of these conclusions are made in a vacuum cleaner as accurate numeric info should copyright the economic choices of every tiny service. Such data is compiled via bookkeeping.

You know the funds that are offered and where they drop short. The news is not constantly great, however at the very least you recognize it.

All About Stonewell Bookkeeping

The puzzle of reductions, credit scores, exceptions, routines, and, obviously, charges, is adequate to merely surrender to the internal revenue service, without a body of well-organized paperwork to sustain your claims. This is why a committed bookkeeper is important to a local business and deserves his/her king's ransom.

Those philanthropic contributions are all enumerated and gone along with by details on the charity and its repayment info. Having this details in order and close at hand allows you file your income tax return with ease. Keep in mind, the federal government doesn't play around when it's time to submit taxes. To make sure, a company can do whatever right and still go through an IRS audit, as many already know.

Your organization return makes claims and depictions and the audit aims at validating them (https://peatix.com/user/28565535/view). Excellent accounting is everything about connecting the dots in between those depictions and truth (best home based franchise). When auditors can follow the info on a journal to invoices, bank statements, and pay stubs, to name a couple of documents, they promptly discover of the competency and integrity of business organization

The Best Guide To Stonewell Bookkeeping

Similarly, careless accounting adds to anxiety and anxiety, it likewise blinds company owner's to the potential they can recognize in the long run. Without the details to see where you are, you are hard-pressed to set a location. Only with reasonable, thorough, and factual data can a company owner or monitoring group story a training course for future success.

Company owner know finest whether an accountant, accounting professional, or both, is the ideal remedy. Both make vital contributions to an organization, though they are not the exact same occupation. Whereas a bookkeeper can gather and arrange the information required to sustain tax preparation, an accounting professional is better matched to prepare the return itself and really examine the revenue declaration.

This article will dig into the, including the and how it can benefit your company. We'll also cover just how to obtain started with bookkeeping for a sound financial ground. Bookkeeping includes recording and organizing economic deals, consisting of sales, acquisitions, settlements, and invoices. It is the procedure of maintaining clear and concise documents to ensure that all financial details is quickly available when required.

By regularly upgrading monetary documents, accounting aids services. Having all the financial information quickly obtainable maintains the tax obligation authorities satisfied and go to website avoids any last-minute headache throughout tax filings. Regular bookkeeping guarantees well-kept and well organized records - https://fliphtml5.com/homepage/hirestonewell/hirestonewell/. This aids in quickly r and saves services from the stress of looking for papers during due dates (best franchises to own).

The Buzz on Stonewell Bookkeeping

They also desire to recognize what potential the business has. These elements can be easily handled with accounting.

By keeping a close eye on economic documents, organizations can establish sensible goals and track their development. Normal bookkeeping ensures that companies stay compliant and avoid any penalties or legal problems.

Single-entry accounting is straightforward and works best for tiny services with few transactions. It does not track assets and obligations, making it much less extensive contrasted to double-entry bookkeeping.

Not known Incorrect Statements About Stonewell Bookkeeping

This could be daily, weekly, or monthly, depending on your business's dimension and the volume of purchases. Do not wait to seek aid from an accountant or bookkeeper if you locate handling your financial records testing. If you are searching for a totally free walkthrough with the Accounting Solution by KPI, contact us today.